Technology vs. people power: risk and compliance in the age of COVID-19

Risk and finance technology has been directly affected by the COVID-19 crisis. This article looks at the underlying forces that dictate how risk and compliance projects are built and how technology evolves: namely, human beings.

Fraud-busting in the new ‘normal’: keeping costs and false positives down post-COVID

Fraudsters are profiting from the pandemic, while financial firms’ fraud-detection systems are swamped with false positives. As firms adjust to a new ‘normal’, graph analytics and supervised and unsupervised models can help them keep pace with criminal…

Insuring the weather: modeling the complexities of climate change

Extreme weather makes forecasting and quantifying insurance losses harder, and ‘cat’ models struggle to predict events more extreme than those in the past. As regulators demand more action, dynamic ‘earth system’ models offer a better way to anticipate…

Is more data, and less math, a good thing in modern models?

Now that Big Data is mainstream, model developers face an epistemic trade-off: enable models to make more accurate predictions by loosening traditional statistical methodologies. But what impact might this have on the future accountability of our…

Biometrics: assessing the opportunities and risks as regulations loom

Biometric technology can enhance fraud and anti-money laundering processes, but can carry big risks. As it becomes more widespread, financial firms and tech vendors must develop the security and governance frameworks to realize its potential – before…

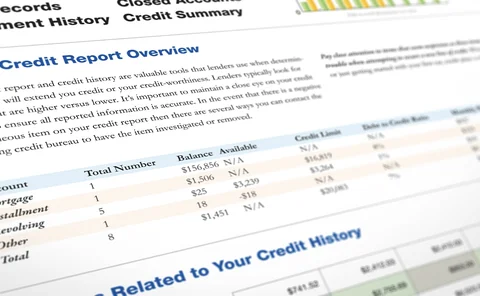

Breaking the doom loop: the danger of self-fulfilling prophecies in modern credit risk

The ability to distribute trustworthy credit is a societal cornerstone. But what happens when traditional credit scoring methodologies aren’t available? Will new 'advanced' credit models in emerging markets be self-fulfilling prophecies?

Meaning is everything: the problem of defining ethics for AI algorithms

Developing AI algorithms without strict definitions could create ethical problems for financial firms. To avoid mishandling their algorithms and potentially harming certain customer groups, firms must ensure their AI tools are no broader than the…

Bad sources? The risks of alternative data

New ways to capture and package previously inaccessible data have given financial institutions (FIs) a diverse set of methods with which to assess the creditworthiness of corporate and retail customers. Despite the appeal, however, deploying this data…

What price privacy as the value of transaction data soars?

Thanks to a booming payments market, the amount of transaction data is growing – as is its value. But regulation around it is patchy at best, and as more transaction data is used to feed models and analysis, more transparency and clarification around its…

Mitigating price risk in Asia’s flourishing LNG markets

The speed at which the liquified natural gas (LNG) market is maturing has created inconsistencies in how LNG is priced – not least in Asia, where growth is fastest. The obvious but untested solution – an Asian pricing hub – will take time to develop, but…

Reinsurers’ IFRS 17 struggles are a reminder that one size does not fit all

The IASB issued IFRS 17 in a bid to standardize insurance contract accounting, but reinsurance firms, because of their particular idiosyncrasies, will struggle to comply. Unless the IASB makes significant modifications to the standard, reinsurers…

All in a name: why ‘private blockchains’ weaken the blockchain case

Many projects labeled ‘private blockchains’ are merely database hygiene or ‘permissioned DLT’ solutions given a more marketing-friendly moniker. But increasing misuse of the term ‘private blockchain’ could create confusion in the market and undermine a…

The risk of clean air

Impending regulation affecting shipping fuel will reduce atmospheric pollution but send shockwaves through the shipping and oil industries. Market players have several strategic options, but uncertainty clouds their choices. To what extent is the…

If you’re not at the table, you’re on the menu: the case for bug bounties

As fear around cyberattacks grows, so-called ‘bug bounties’ offer firms an opportunity to buy information on security vulnerabilities in their systems before they become public or fall into the hands of bad actors. In future, these transactions will be…

For growing FinTechs, risk technology will be a must to appease tougher regulators

In striving for growth, many FinTech firms enter different markets with solutions that use the same underlying technology. As highlighted by recent AML-related issues, however, this technology is seldom regulation-friendly. To withstand deeper inbound…

Breaking the glass box: achieving ‘explainability’ that actually explains

Tied to the growing popularity of machine learning (ML) tools is the need to explain their underlying rationale. But buzzwords, like ‘glass box’, are steering the explainability conversation off course. Meanwhile, without proper investment in the tech…

The IFRS lull: firms must end box-ticking and start hand-shaking

A relative lull in transformative IFRS-related system implementations means that financial firms can relax a little. But not too much: now is the time to work strategically with other players to create real value from IFRS compliance.

Why more is not always better in the world of credit

Advanced analytics and AI promise revolutions everywhere, but real-world constraints abound. This is notably true in the world of credit scoring, which needs to be understandable, is often slow to give out real-world results, and can be muddied by the…

The Rhode to ruin? Why stock-drop lawsuits threaten cyber security

A lawsuit against Google’s parent Alphabet threatens broader data security. Regulators should provide clarity on breach disclosure timelines; financial services institutions and suppliers should welcome it.

Regulators need a robust taxonomy of tools before tackling AI

Regulating AI is a challenge that must and will be faced. Central to effective regulation will be a robust, accurate taxonomy of the multiplicity of available AI techniques.